Understanding Equipment Breakdown Insurance

What is Equipment Breakdown Insurance?

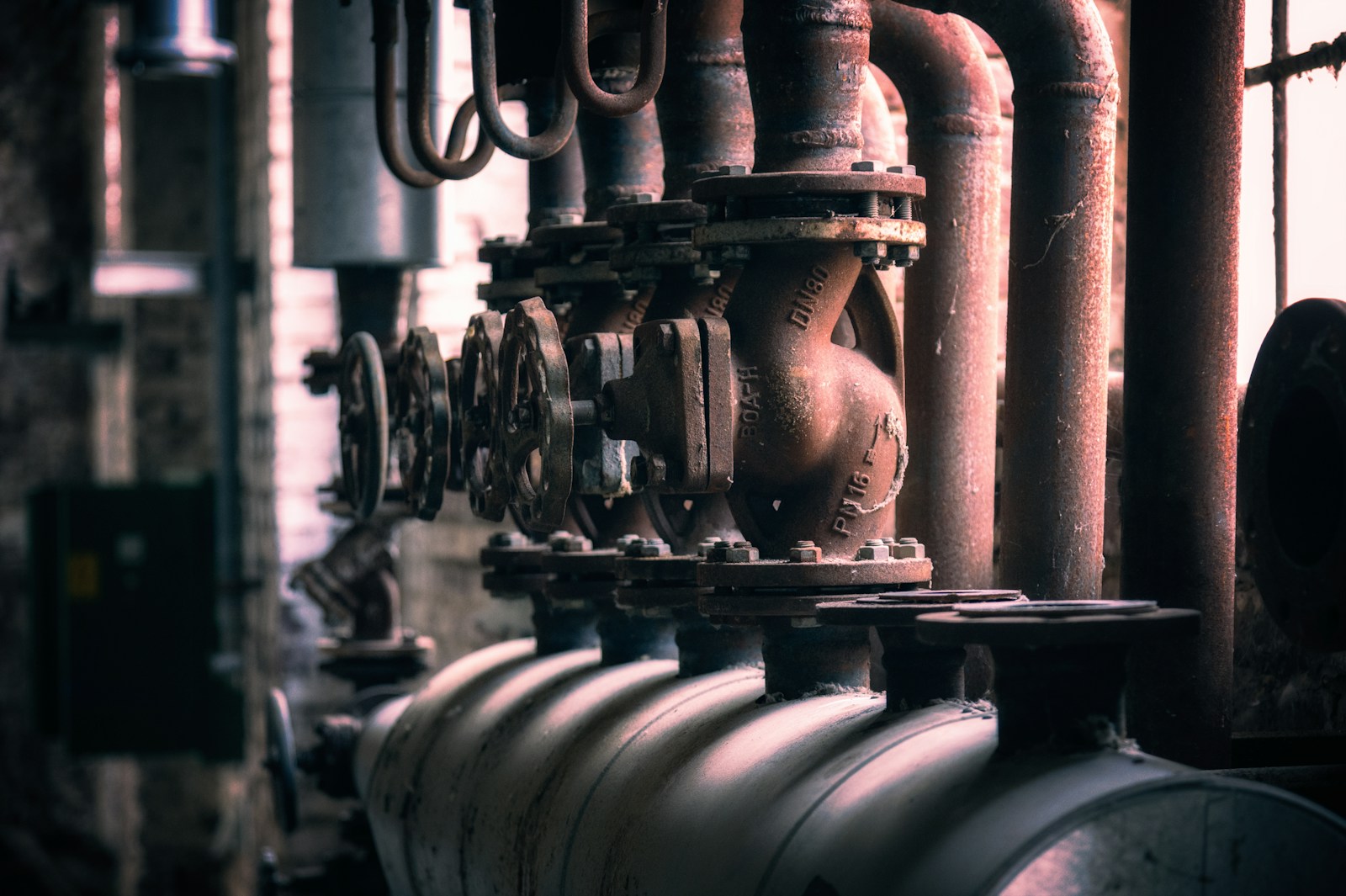

Equipment breakdown insurance covers damages and malfunctions related to electrical, mechanical, and computerized equipment. Even if you don't own the building where you operate, this insurance can provide substantial benefits.

What Does Equipment Breakdown Insurance Include?

Equipment breakdown insurance typically covers five main categories:

- Electrical Systems: Coverage for cables, electrical panels, and transformers.

- Mechanical Systems: Protection for elevators, water pumps, engines, specialized equipment, and motors.

- Boilers and Pressure Vessels

- Computers and Communication Systems: Coverage for security systems, voicemail, and fire alarm systems.

- Refrigeration and Air Conditioning Systems

Additionally, this insurance can cover:

- Lost income due to equipment failure

- Expenses incurred during the restoration period

- Spoiled inventory

- Costs for repairing or replacing damaged equipment, including labor

- Reputational recovery efforts

- Data restoration

It's important to note that routine wear and tear typically isn't covered under this insurance.

Why Equipment Breakdown Insurance is Essential

Equipment breakdown insurance ensures that any losses resulting from equipment failures are covered. It takes care of repair or replacement costs for the insured equipment and can extend to cover damages caused to surrounding property and loss of business income due to equipment downtime.

Key Benefits of Equipment Breakdown Insurance

Prevent Financial Losses

This insurance helps businesses avoid significant financial setbacks due to unexpected equipment failures. It covers repair and replacement costs, ensuring your operations can resume quickly without incurring hefty out-of-pocket expenses.

Protect Your Revenue

By covering the loss of income caused by equipment breakdowns, this insurance ensures that your business remains financially stable, even during unexpected downtimes.

Enhance Business Reputation

Maintaining smooth operations and avoiding prolonged downtimes helps preserve your business's reputation. Customers and clients are less likely to be impacted by operational disruptions, which can enhance your business's credibility and reliability.

Tips for Selecting Equipment Breakdown Insurance

Regular Inspections

Consider policies that include regular inspections of your equipment. Early detection of potential issues can prevent major breakdowns and costly repairs, ensuring your operations run smoothly.

Property Damage Coverage

Ensure that your policy covers any property damage caused by equipment failures. For instance, if a malfunctioning machine causes damage to adjacent properties, your insurance should mitigate your liability for those damages.

Temporary and Rush Repairs

Look for policies that cover temporary or rush repairs. If a critical piece of equipment fails, having the option for expedited repairs can minimize downtime and keep your business running smoothly.

Comprehensive Incident Coverage

Choose a policy that covers a wide range of incidents relevant to your business, such as mechanical failures, power surges, and motor burnouts. Thoroughly review the policy details to ensure comprehensive protection.

Income Protection

Make sure your policy includes coverage for lost business income due to equipment breakdowns. Confirm with your insurance provider that the coverage limits are adequate for your business needs.

Get a Quote for Equipment Breakdown Insurance

Protect your business from the financial impact of equipment failures by securing the right insurance policy. Contact Bozzuto Group to discuss your needs and get a tailored quote for equipment breakdown insurance.

Get a Quote

Ensure your business is safeguarded against unexpected equipment breakdowns with comprehensive coverage from Bozzuto Group.

Get A Quote

Protect your business and its leaders by contacting Bozzuto Group. We can assist you in finding the right insurance policy tailored to your business needs.