Comprehensive Stock Throughput Insurance for Businesses

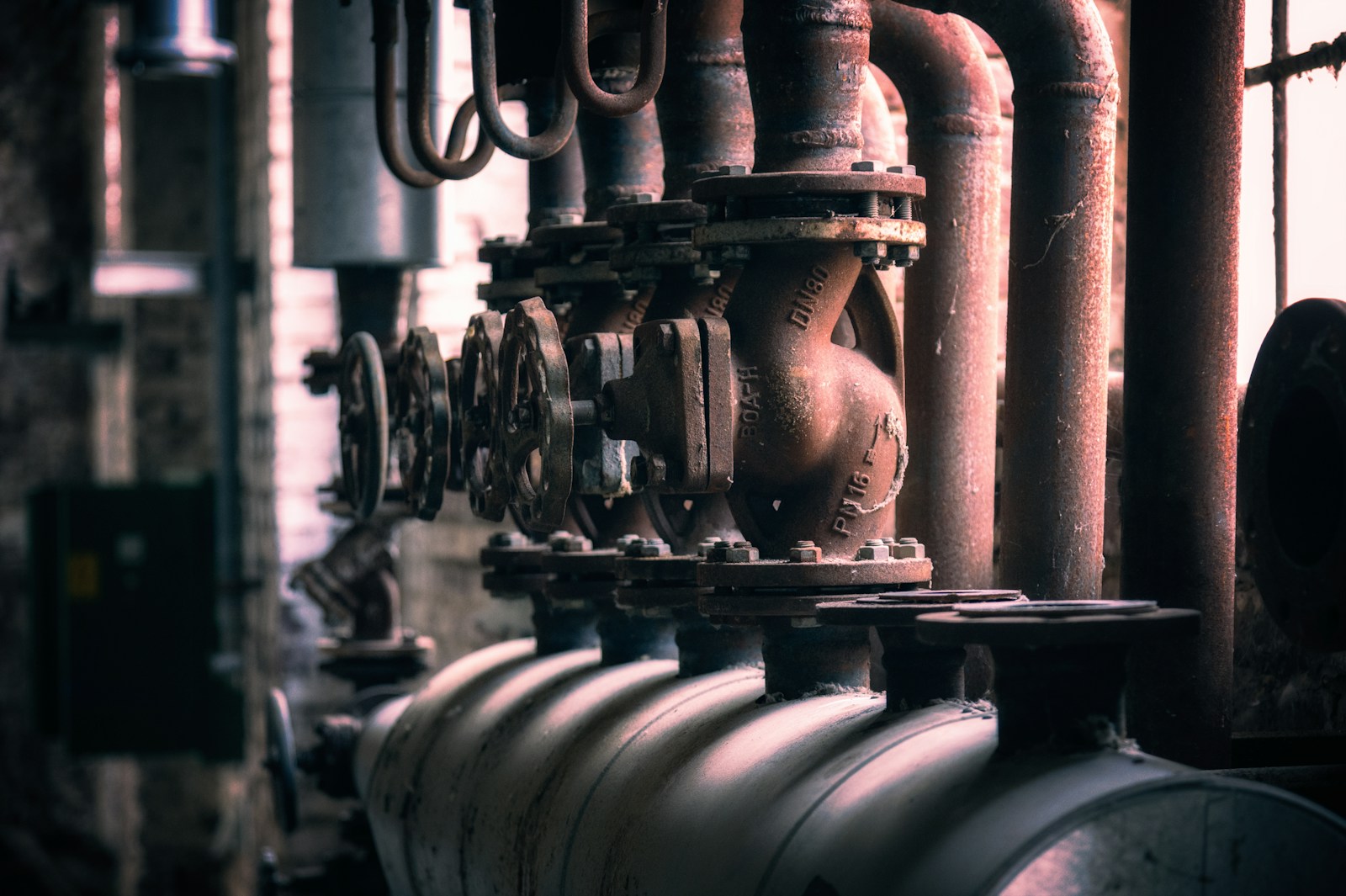

As a business owner, ensuring the protection of your inventory throughout its lifecycle is crucial. Stock Throughput Insurance provides coverage for your products during transit (by air, land, and sea) and while in storage. This protection applies regardless of whether the storage facility is owned by your business or a third party.

While this insurance is particularly beneficial for manufacturers, distributors, and retailers, it is valuable for any operation. Stock Throughput Insurance safeguards your investment until your risk and/or interest ends.

Coverage Scope of Stock Throughput Insurance

Stock Throughput Insurance covers every stage of the product lifecycle, including:

- Sourcing and planting of seeds

- Growth phase

- Processing

- Storage, regardless of the stage of operation

- Transit by air, land, or sea

- In some cases, coverage extends beyond the final delivery if a financial interest is present, up until it reaches the buyer.

Components of Stock Throughput Insurance

Stock Throughput Insurance comprises three main components:

- Ocean cargo insurance

- Inland transit insurance

- Property or storage insurance

Each component covers a specific mode of transportation, ensuring that your inventory, whether raw materials, semi-finished, or finished products, is adequately protected at all times. This coverage also applies to goods undergoing processing or stored at a facility, whether owned by your business or a third party.

Advantages of Stock Throughput Insurance

The primary advantage of Stock Throughput Insurance is its comprehensive "cradle to grave" coverage, protecting your raw materials, goods, and merchandise from the moment you have an insurable interest until it ceases. This provides peace of mind, knowing your products are covered throughout their entire lifecycle.

Stock Throughput Insurance is often compared to Marine Insurance and Business Property Insurance. However, it offers more extensive coverage, including protection against windstorms, earthquakes, and floods. When paired with Business Property Insurance, you gain comprehensive protection. In the event of a catastrophe, your Stock Throughput policy covers all damaged or lost stock/products, while Business Property Insurance covers damage or loss to buildings and equipment.

Tips for Choosing the Right Stock Throughput Insurance

Work with a Specialized Broker

Select a qualified broker specializing in the natural products and supplement industry. An experienced broker will guide you through the process and tailor an insurance package to meet your specific needs, considering all your business exposures.

Ensure Adequate Coverage

Avoid the temptation to opt for the cheapest insurance policy. Gaps in coverage can result in significant out-of-pocket expenses in the event of a claim. Carefully review your insurance policy to ensure comprehensive coverage.

Understand Your Business Exposures

When selecting a broker, ensure they have established relationships with multiple underwriters. Additionally, have a clear understanding of your business exposures to accurately estimate the premium you will need to pay.

Secure Your Business with Throughput Insurance

Protect your business by working with Bozzuto Group. We can help you find the right policy tailored to your needs. Contact us today for a quote.

Get A Quote

Protect your business and its leaders by contacting Bozzuto Group. We can assist you in finding the right insurance policy tailored to your business needs.