Captive Insurance

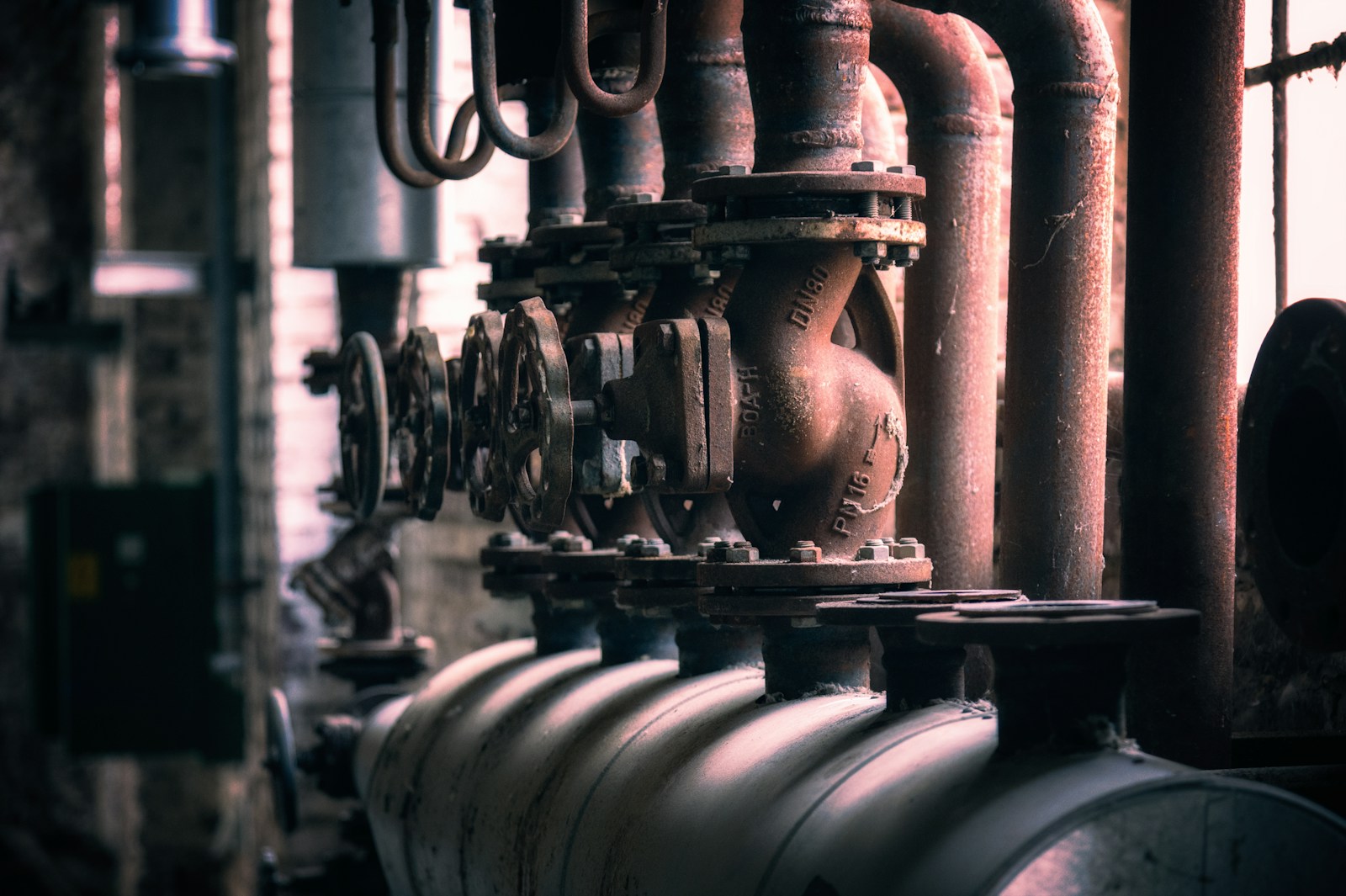

Captive Insurance allows businesses to create their own insurance company to cover the risks of their operations. Rather than relying on traditional insurance carriers, a business sets up its own subsidiary to manage its risk and provide tailored coverage for unique or high-risk exposures.

Captive Insurance offers several benefits, including greater control over your insurance strategy, the ability to customize coverage, and the opportunity to save on premiums by retaining risk within the organization. It’s particularly suitable for businesses that face large or specialized risks that are not easily covered by standard policies.

In addition to customized coverage, Captive Insurance can help businesses accumulate reserves and retain underwriting profits that would otherwise go to a third-party insurer. This approach can also provide tax advantages, depending on the structure and jurisdiction of the captive.

If your business has unique or specialized risk management needs, Captive Insurance may be the right solution.

Get A Quote

Protect your business and its leaders by contacting Bozzuto Group. We can assist you in finding the right insurance policy tailored to your business needs.